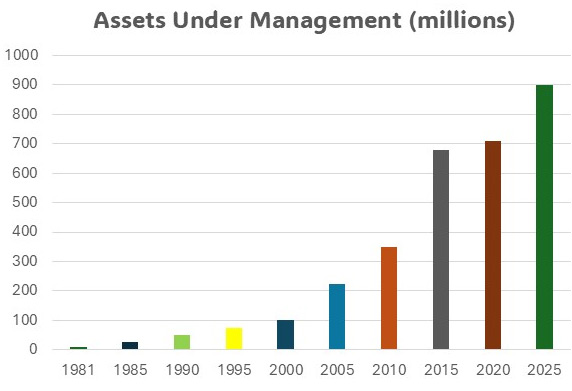

Terril & Company is an independent wealth management company founded in 1979 by John “Joe” Terril. Since then, referrals from satisfied clients and third-party professionals have fueled virtually 100% of its growth.

The company takes a highly personal approach to serving clients, who typically include high net worth individuals, trusts and private/corporate retirement plans. Terril staff members answer their own phones and offer attentive one-on-one personal service.

The investment selections Terril makes are based solely on their potential to produce positive, long-term returns. The firm derives 100% of its revenue from disclosed client fees. It receives no compensation from any other source related to client accounts.

WHY TERRIL

Why Investors Continue to Choose Terril & Company

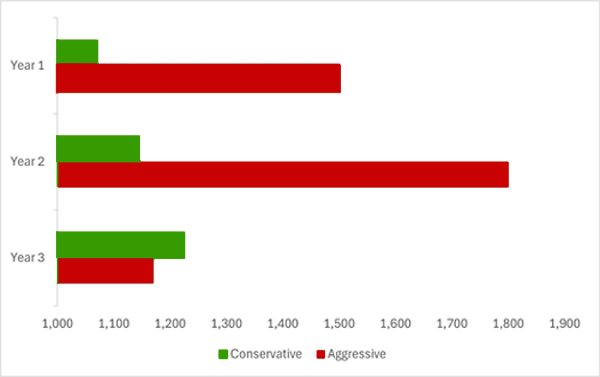

Why Terril & Company’s Conservative Approach Often Outperforms Aggressive Portfolios

A Terril investment tenet: It’s not so much about what you earn in good markets. It’s what you DON’T LOSE when things turn bad.

When comparing rates of return over a multi-year period, it’s the CUMULATIVE rate of return that matters most as the following illustration demonstrates.

| Conservative Portfolio | Rate of Return |

|---|---|

| Year 1 | 7% |

| Year 2 | 7% |

| Year 3 | 7% |

This portfolio obviously averaged 7%. The cumulative return is 22.50 % due to the super important calculation of compounding.

| Aggressive Portfolio | Rate of Return |

|---|---|

| Year 1 | 50% |

| Year 2 | 20% |

| Year 3 | -35% |

In this example, a conservatively managed portfolio that steadily posts a 7% arithmetic return over a 3-year period generates a cumulative return of 22.50% due to the effect of compounding. While the arithmetic average return of the aggressive portfolio is 11.625% over 3 years, its cumulative return is only 17%. (1.5 X1.2 X. 65 ) While the huge gains it logged in years 1 and 2 dwarf the performance of the conservative portfolio, aggressive investors often experience significant deterioration of previous gains during market corrections. That was the case most recently in 2022 when fully invested portfolios lost approximately 23% of their market value.

At TERRIL & COMPANY we realize the maxim “It’s not what you earn in good markets that counts. It’s what you don’t lose in bad markets that is most important.”

Philosophy

Discipline, Patience, and Long-Term Focus

As a registered investment advisor, we believe that true success comes from making disciplined decisions and having a long-term vision. Our services are built on patience, careful risk assessment, and strategies designed to protect wealth while pursuing consistent growth.